2022 was a year for bold bad predictions, 2023 was a year of calm predictions following the storm, and we predict 2024 is a year of the rising tidal wave.

Here’s our annual ̶p̶r̶o̶p̶a̶g̶a̶n̶d̶a̶ predictions:

1. Bitcoin breaks all time highs by Christmas 2024. Breaks into six digits in 2025

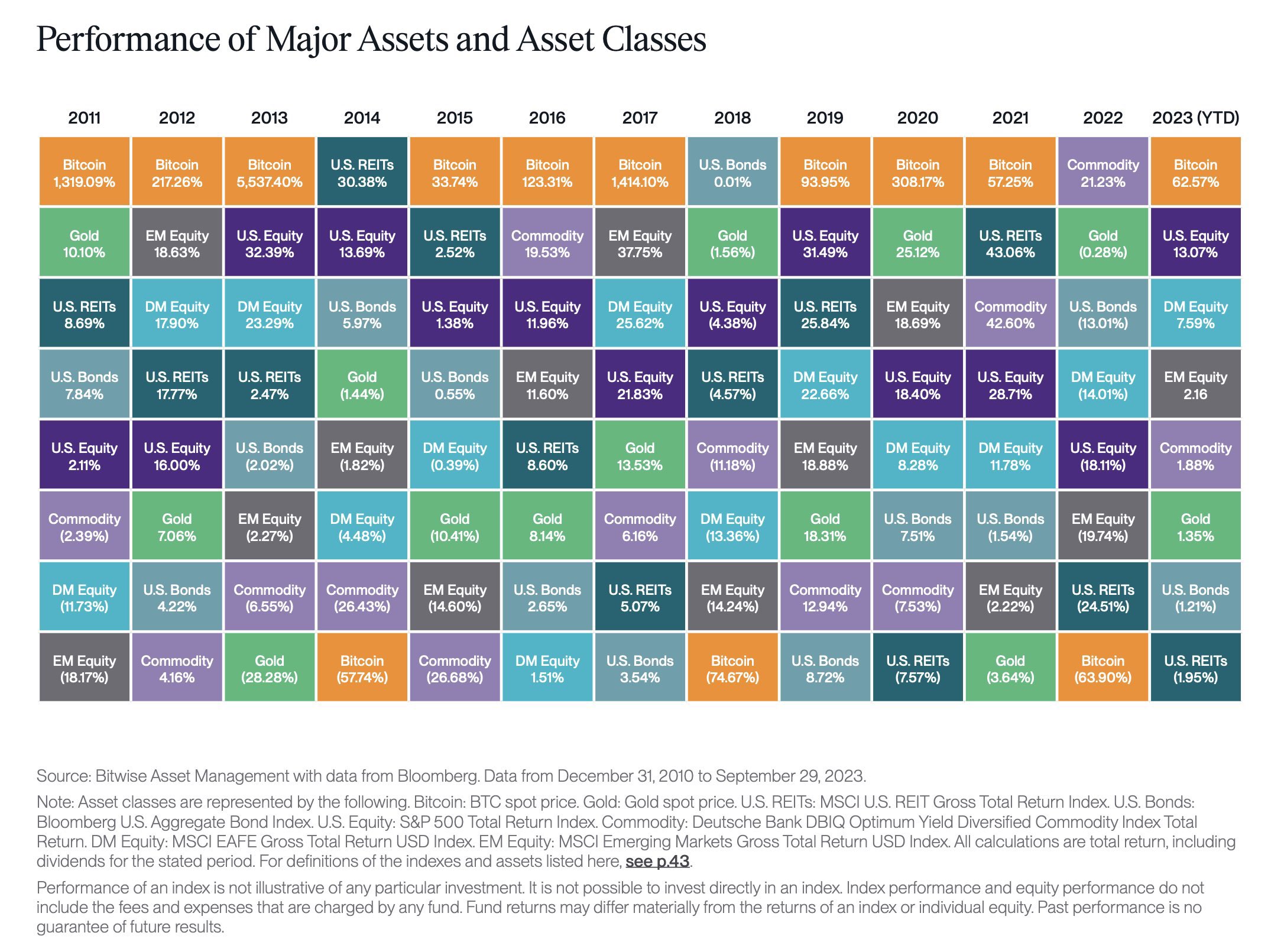

History rhyming or repeating with Bitcoin performing well this year seems likely (unless traditional markets fall apart).

Obviously, past performance isn’t a guarantee of future results. However, with the tailwinds of the spot Bitcoin ETF, Bitcoin Halvening in April, inflation, and global uncertainty, I’d say that Bitcoin should outperform these below asset classes as it has in every cycle when it’s a positive year for Bitcoin.

2. Solana breaks all time highs by end of year 2024. SOL will eclipse $1,000 in 2025

This will be more difficult as it would require a ~2.5x. However, if traditional markets don’t tank, Solana seems like the “safest” alt currency out there.

Solana ecosystem developers are picking up, the narrative is strong, and Visa is using Solana for stablecoin transactions. This is compelling evidence that Solana’s chain can do a high number of transactions at high speed and has material, real-world utility.

Ethereum (Solana’s largest competitor) has high transaction (gas) fees that make it nearly unusable for small transactions during peak blockchain activity. In the short term, Ethereum for “all transactions” isn’t feasible unless rollups or other layer-2 solutions, designed to scale Ethereum for handling more transactions simultaneously at a reduced gas cost, gain widespread popularity and success.

If we get another runaway bull market, SOL to $1,000 seems difficult, yet feasible in 2025.

3. BlackRock’s Spot Bitcoin ETF has the highest trading volume + net inflows of ETFs in 2024

BlackRock is the king of ETFs in traditional finance, and I don’t see Fidelity and/or any crypto native Spot Bitcoin ETF provider topping BlackRock’s Bitcoin ETF in volume or net inflows.

While BlackRock is bringing a ton of money into Bitcoin which is good, they are an entity that needs to be monitored in the coming years as they begin to own more Bitcoin and potentially mine it.

They need to be watched because BlackRock’s heavy promotion of DEI mandates could lead them to evaluate forking Bitcoin into a “Green Bitcoin” that is controlled by them and/or governments (even though >50% of bitcoin is mined via renewable energy according to Bloomberg).

Bitcoin has value because it is controlled by millions of individuals — not by large institutions or governments.

Bitwise and VanEck’s Spot Bitcoin ETFs seem to be the most “pro crypto” ETF providers with part of their crypto ETF’s profits being donated towards crypto charities (other providers don’t).

4. 2024 isn’t peak “mania” for crypto

I believe the Spot Bitcoin ETF approval will lead to a slow drip of investments into Bitcoin.

Asset managers and financial advisors become more educated and recommend a ~1–2% portfolio allocation to Bitcoin in the coming years and this leads to a slow faucet of continual Bitcoin buys that doesn’t turn off for the next 5–10 years.

Bitcoin never has another -85% year due to asset class maturing, leading to less volatility on up/downside, and more investors having the ability to easily buy Bitcoin.

5. Big year for AI crypto projects — 3 AI coins in the top 25 market cap by the end of the year

While we’re still in the early innings of AI being used, ChatGPT is the most powerful application I’ve used in my 28 years.

ChatGPT allows you to have an all-knowing genius of all topics at your immediate disposal, at any time of day.

The scientific breakthroughs that will happen through AI will be astounding. The productivity of humans will skyrocket with these powerful second consciousnesses.

AI is so powerful that the amount of money that has and will continually be put into it will be staggering.

Because of this, I believe AI projects/tokens will be some of the best performing assets in 2024.

TAO, Render, Fetch.ai, and Morpheus, are some of the most promising and best positioned projects poised to benefit (in our biased opinion).

Disclosure: This is not financial advice. Do your own research. Past performance is not indicative of future results. Bitcoin and cryptocurrencies are extremely “risky” investments. The author(s) may own the cryptocurrencies mentioned.