Banks failing domestically and internationally dominated Q1’s headlines.

With the 2nd and 3rd largest bank failures in US history and household international bank Credit Suisse going under, confidence is shaken in the banking/financial system. (Note: this Q1 “Thoughts” report is being published unintentionally late on May 3rd as First Republic failed May 1st and banks PacWest + Western Alliance are on the ropes)

With the war in Ukraine, inflation, post covid economic uncertainty, and now serious banking concerns, it’s hard to know who or what to trust or believe. Maybe this is all noise, and everything is fine — there always have been ongoing crises and there always will be.

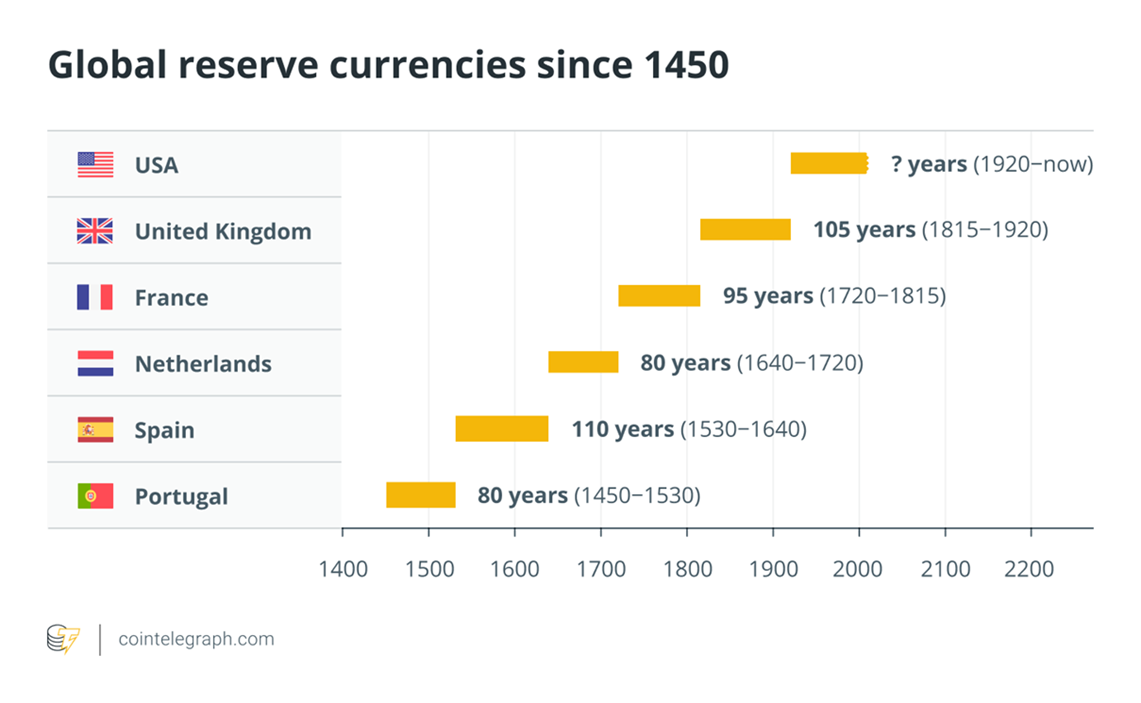

I’ve never been in times like these before and trust/belief in something is rare for me to find currently. I don’t trust a banking system that eliminated its fractional reserve requirement of holding 10% of their funds in cash at their bank in 2020 to 0% dollars being required. I don’t trust a US dollar that is rapidly being printed and backed on nothing but “belief” in the US financial system (dollars stopped being backed by gold in 1971). History shows that the US Dollar remaining the world’s reserve currency isn’t a guarantee.

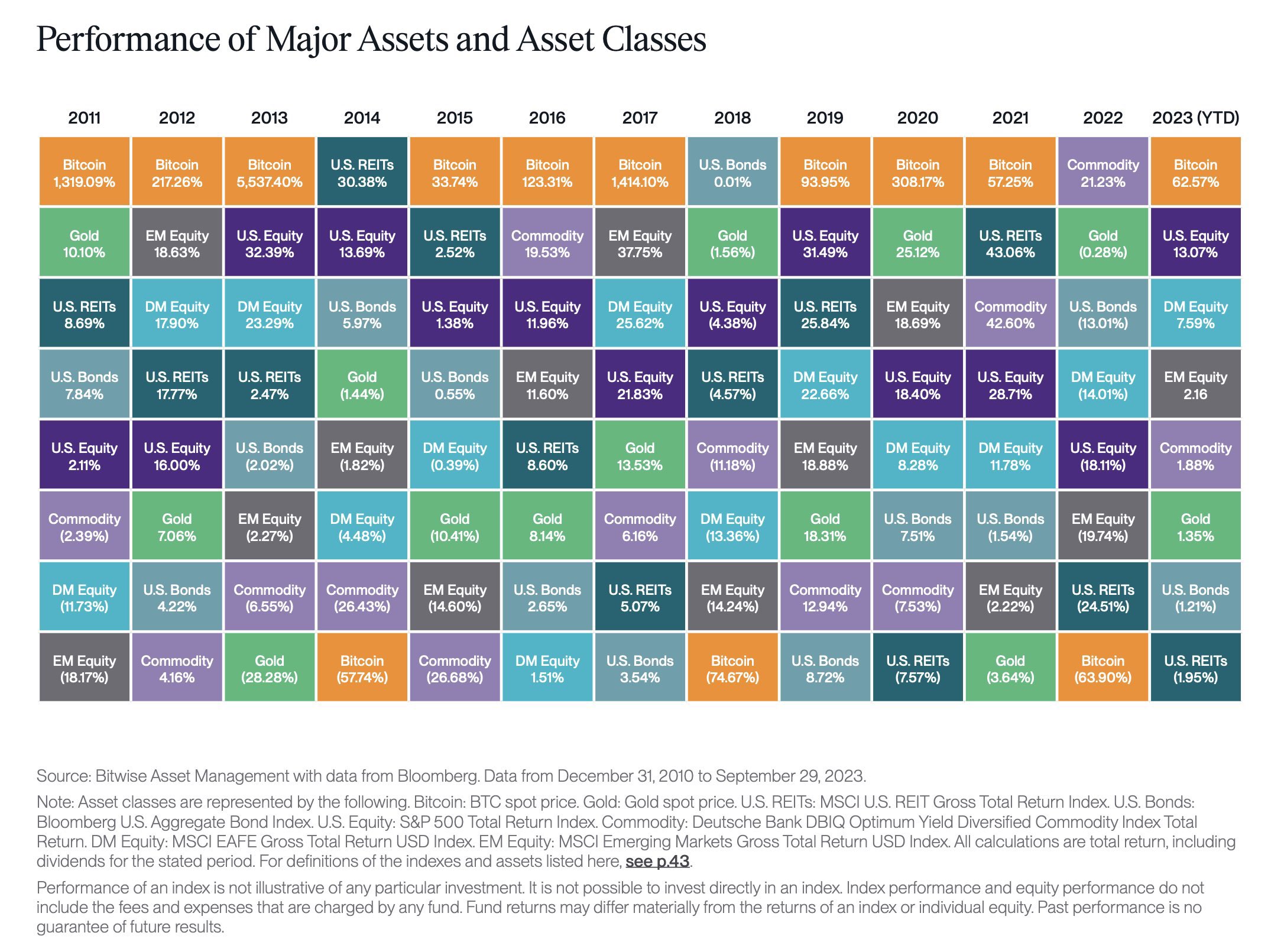

Some people use hard assets like gold, real estate, and livestock as hedges against this. Some now use Bitcoin as a hard asset because only 21 million Bitcoin will ever be created, unlike paper currencies like the US Dollar where you can print infinite amounts of cash.

I don’t believe the Chinese Yuan is that great. Due to China’s influence, it likely has the best odds of replacing the dollar if a fiat (country issued) currency does. The EU is currently a dumpster fire so, I doubt the Euro would replace the dollar. Potentially a basket of fiat currencies could be an option.

None of these fiat currencies are really backed by any hard asset i.e., gold. So, I believe Bitcoin, a digital currency with a permanently fixed supply (you can’t mine more than 21 million Bitcoin) that is loved by individuals across the globe and continues to be more broadly adopted has decent odds as a replacement if the Dollar loses its “reserve” status. Particularly as most global commerce is now conducted digitally.

The previous five reserve currencies lasted on average 94 years and the US dollar is around ~103 years into its reign (the destruction of WWI led to the US dollar taking over as the global reserve currency).

Talking With AI:

I asked ChatGPT “what leads to a country losing its ‘Reserve Currency’ status?”, the AI’s answer was:

“A country can lose its reserve currency status due to a variety of factors, including:

1. Economic instability

2. Political instability

3. Global economic shifts

4. Shift in global financial markets

5. Geopolitical events

It’s worth noting that ChatGPT also spat out: “Even if another currency were to challenge the US dollar’s position as the world’s reserve currency, it would likely be a gradual and slow process, rather than an abrupt shift.”

Thoughts I Believe:

I don’t try to be more intelligent than our new AI overloads. However, I disagree because in today’s world a couple of tweets can implode the global financial system.

Case in point: Silicon Valley Bank vanished virtually overnight as customers simply clicked “withdraw” on SVB’s online banking portal. With the internet multiplying network effects exponentially, change happens fast in today’s world.

If the existing global financial system is put at risk by a few tweets and a few people clicking “withdraw”, then the system is not sound and extremely vulnerable.

Maybe ChatGPT already knows this and is trying to do what our banks and governments already do: squash all fears and talks of bank runs relentlessly (lol).

50/50 is a better bet in my (biased) view on whether it’s a “gradual and slow process” or an “abrupt shift.”

In Conclusion:

I think everyone inherently knows that there’s something wrong with our financial system but can’t pinpoint what specifically about it is wrong.

I believe it is sound money — currency backed by bitcoin, gold, or other hard assets is the answer.

This isn’t a doom and gloom update. It’s more of a “hey, history says the dollar remaining as the global reserve currency isn’t a guarantee.”

What one does with this statement or the conclusions they come up with, is up to them.

Drop us a note with your thoughts or questions.

Disclosure: this is not financial advice. I am not a financial advisor.