Acceptance of Bitcoin in the financial system will be cemented by having a spot Bitcoin ETF. Bitcoin is on the cusp of having a spot Bitcoin ETF approved with the world’s largest asset manager, BlackRock, as its sponsor.

BlackRock’s CEO Larry Fink can be found regularly tooting the horn of crypto on major news outlets.

I am pleased to welcome Bitcoin’s new Chief Marketing Officer, Larry Fink. Larry will be focusing on Bitcoin adoption in the institutional channel. Welcome Larry! Let’s see a new ATH. 🙃🚀pic.twitter.com/kCVGG6mCOy

— Gabor Gurbacs (@gaborgurbacs) July 14, 2023

Two of the three largest asset managers in the world have spot Bitcoin ETF applications pending, with Fidelity refiling for a spot Bitcoin ETF on June 29th, highlighting the institutional demand for this product.

What Does a Spot Bitcoin ETF Approval Mean?

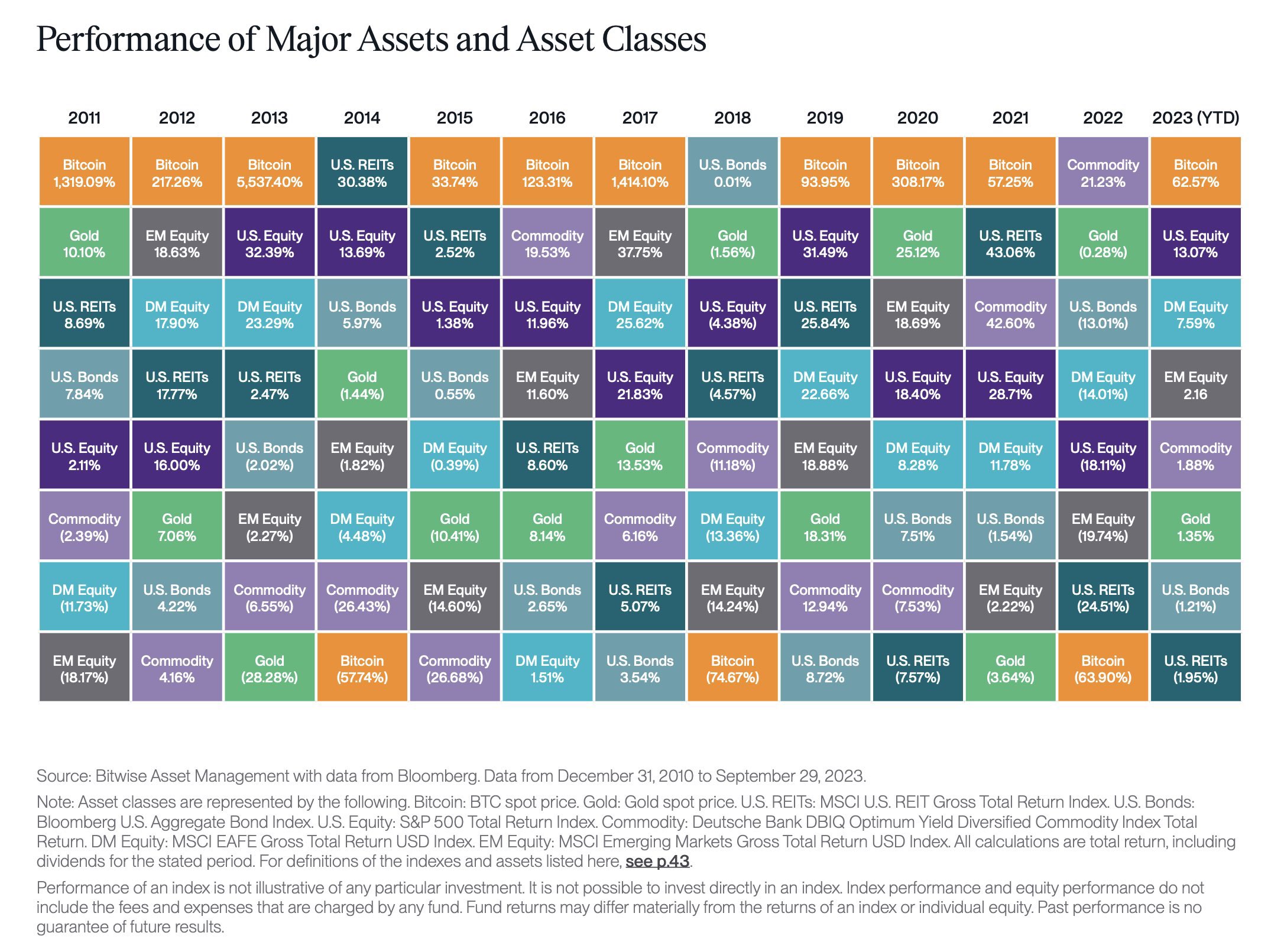

Traditional finance i.e., institutions, asset managers, and pension funds can finally invest in Bitcoin.

In most fund mandates (rules for how an institution can or can’t invest), investing in an asset class through an ETF is acceptable. Direct investment in Bitcoin, however, currently is not.

With an ETF approval, the amount of capital able to be invested in Bitcoin will expand by orders of magnitude. This doesn’t guarantee that people will buy — just because you’re given the freedom to buy cigarettes doesn’t ensure that you will.

However, the prospect of financial advisors being able to say, “we can allocate ~1% of your assets into digital currencies with the click of a button”, becomes a reality.

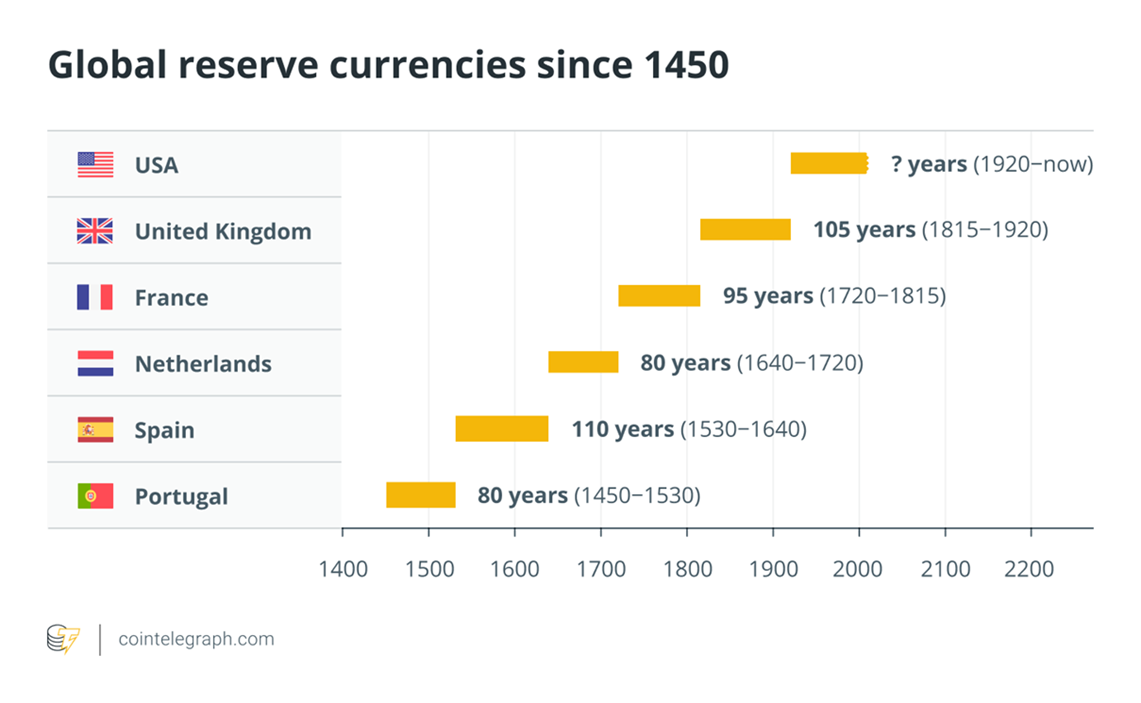

History Likes to Rhyme

Let’s look at gold and when gold had a spot ETF approved years ago.

The 1st gold ETF SPDR Gold Shares (NYSE: GLD) was approved on November 18th, 2004.

Spot gold price in Nov. 2004 was approximately $450, prior to the approval.

Spot gold went to above $1,820 in Aug. 2011 (post approval) representing an approximate 350% increase in the price of gold over a seven-year period.

When the friction is removed for institutions (the big money) to easily buy a desired asset, the floodgates will open.

Bitcoin’s market cap at time of writing (Aug. 31, 2023) is approximately $500 billion and the price is around $27,000.

BlackRock’s assets under management (AUM) are $9.43 trillion as of July 2023.

The Numbers Below Are Hypotheticals

If 1% of BlackRock’s assets went into Bitcoin, that would lead to about $100 billion worth of buy pressure.

If 0.5% of their assets did, about $50 billion worth of buy pressure.

If 2% of their assets did, about $200 billion worth of buy pressure.

Quantifying what this amount of buy pressure would do to the price of Bitcoin is difficult.

However, if BlackRock’s or other’s spot Bitcoin ETF applications are approved, the demand for Bitcoin could go up exponentially.

For example, MicroStrategy owns 152,800 Bitcoin representing 0.726% of the total 21 million bitcoins that will ever be mined as of August 2023.

The 152,800 Bitcoins that MicroStrategy owns are only worth around $4.13 billion — 0.5% of BlackRock’s AUM is 10x higher than that.

What the Market is Showing Us

It appears traditional finance is betting on a spot Bitcoin ETF being approved. Crypto “proxy” stocks like Coinbase and Riot Blockchain are being wildly bought up, with both of them more than doubling this year.

Who knows what will happen, but if the world’s largest (and arguably most influential) and 3rd largest asset manager are determined to have a spot Bitcoin ETF approved, the odds look likely.

Bloomberg analysts have the odds at a 75% likelihood of a spot Bitcoin ETF approval by the end of 2023 and a 95% likelihood by the end of 2024.

A spot Bitcoin ETF approval is the holy grail for crypto acceptance.

Its implications on the market and the world are potentially massive.

(Disclosure: This is not financial advice, I’m not a financial advisor)