The Good Predictions:

Creator Economy Explodes

The creator economy is where internet, social media, and “on chain” products intersect to create massive leverage for artists with large audiences via NFTs.

NFTs unlock new revenue streams for creators, i.e., musicians selling special NFTs (digital art piece) to “premium ticket” purchasers who get to meet and get signatures from artist after concerts, limited music releases to NFT purchasers, etc.

“Starving Artist” title will die for quality artists with audiences who know how to monetize their following.

NFTs will catalyze a period of exponential growth in the creative space because artists will be able to monetize their following like never before.

Crypto infrastructure projects steal spotlight

Blockchains are beginning to scale, using systems that lower transaction fees, and interacting with other blockchains. Bring your plunger, the crypto infrastructure’s pipes are about to get cleaned.

Pocket Network (POKT #105 market cap) is a critical piece of this infrastructure that allows data to go “cross chain” and goes from #105 in market cap into the top 15 market cap.

The Bad Predictions:

Big blockchain and crypto companies fail

TerraUSD’s (UST #15 market cap) redemption mechanism issues make them susceptible to bank runs. i.e. UST is backed by Terra (LUNA #9 market cap) and when you redeem UST, you’re paid out in LUNA which creates a self-reinforcing feedback loop. This dangerous design makes it more of a “when” vs. an “if” of LUNA + UST collapsing in our opinion.

Celsius has deployed risky borrowing/lending activities and performed questionable tactics to earn enough yield to pay their borrowers. Several members of their C-Suite have backgrounds tainted with money laundering. We predict they go under in ’22 for one of these or other related issues.

Metaverse token’s market cap value falls off a cliff

Two projects, MANA and Sandbox, are currently at a ~$3.5b market cap valuation but finish the year below $1b market cap. The current quality of the product is comparable to playing “Sims” on a PC in 2001 and the number of active users number in the hundreds-thousands

However, a large correction in these tokens speaks to more of their current quality vs. being indicative of the metaverse being a “sham.” The metaverse is important because once the technology is better: why fly to Tokyo for a face to face meeting when you can put your goggles on, walk in to a conference room, and talk business face to face (crazy, right)? No 14-hour flights, hotel rooms, travel expenses, or time away from family to conduct business.

Once the tech is better, it’s hard to fathom how much of our time will be spent in “real” life vs. the metaverse.

The Underdog Prediction:

Another country adopts bitcoin as legal tender

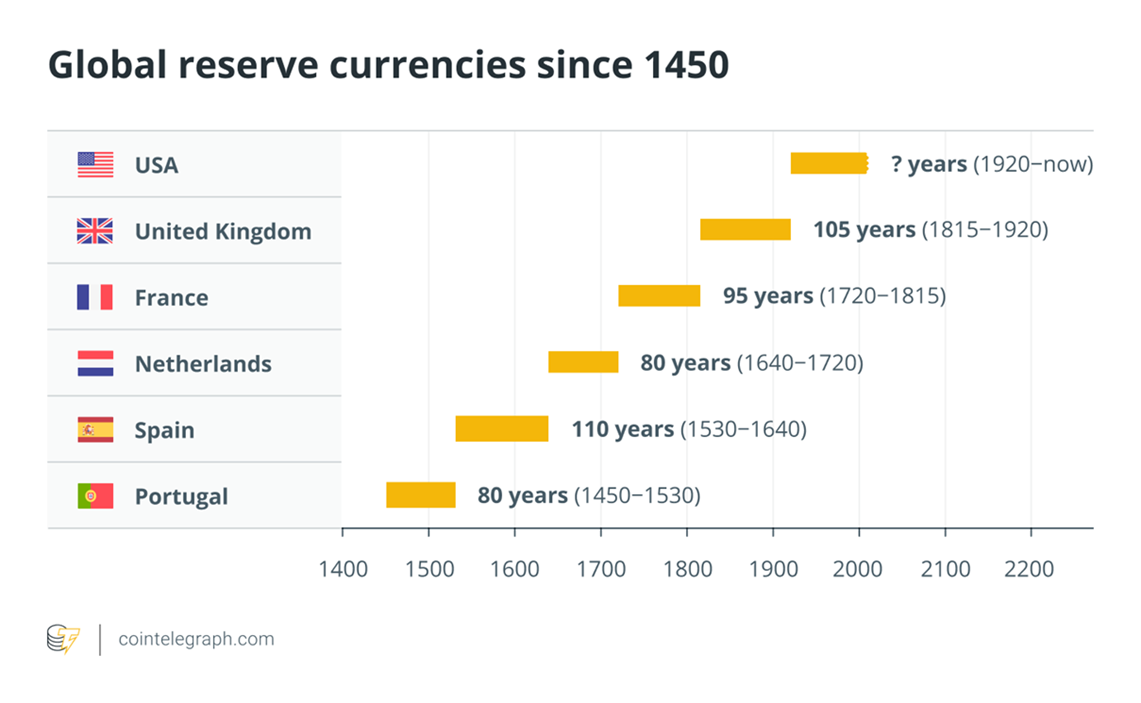

El Salvador led the charge because they didn’t have much to lose. They have no national currency and are currently using USD as their legal tender which is losing its purchasing power faster than it has in the last forty years. Adopting Bitcoin as legal tender allows them to offset the dollar’s inflationary policy with an asset capped at a fixed supply of 21 million.

Here are the other countries that don’t have a national currency with the highest incentives to adopt Bitcoin as legal status: Ecuador, East Timor, Marshall Islands, Micronesia, Palau, Turks and Caicos, the British Virgin Islands, and Zimbabwe.

I expect one of these countries to adopt Bitcoin as legal tender next. Latin American countries with their own national currencies but with a decrepit history of inflation, dictatorship, corruption, and lack of trust in governing bodies are on deck following these. South American countries have the highest adoption rate of cryptocurrencies in the world. Argentinians whose currency inflates ~50% a year on average don’t need to be sold on the beauty of an asset with no inflation.

Disclosure: Not financial advise. The author may have positions in the assets discussed. Grammar edits on 2/1/2022.