Intro

Crypto has been a necessity in corrupt and inflation ridden countries like Argentina, Nigeria, and Turkey for years.

There is no longer a debate whether decentralized money is needed by individuals in western countries after Canada froze peaceful protestor’s bank accounts in February (whether the protests were right/wrong, reDeFi doesn’t know).

There is no longer a debate whether decentralized money is needed by individuals in non-western countries after the U.S. kicked Russia out of SWIFT collapsing the Ruble and Russian citizens’ access to banking in March.

Citizens of both western and eastern countries see the necessity for owning money that their government and foreign governments can’t manipulate. Governments of the world hate this because they love controlling everything possible.

If you don’t understand this, I can’t help you.

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” -Satoshi Nakamoto

What’s important to humans?

Protection of your assets. Governments can impose their will on their citizens or enemies’ residents through weaponized finance i.e., Russian citizens. The Russian Ruble over twenty percent in one week due to U.S. sanctions on Russia.

What’s been proven in 2022 is that if you are against an existing power structure, the “in-crowd,” or a member or citizen of the wrong place or country, your currency and ability to transact can be ruined in a moment’s notice.

That is terrifying.

Power structures, political leaders, and the media may currently fit your preference. But what if one of these three factors changes against your liking?

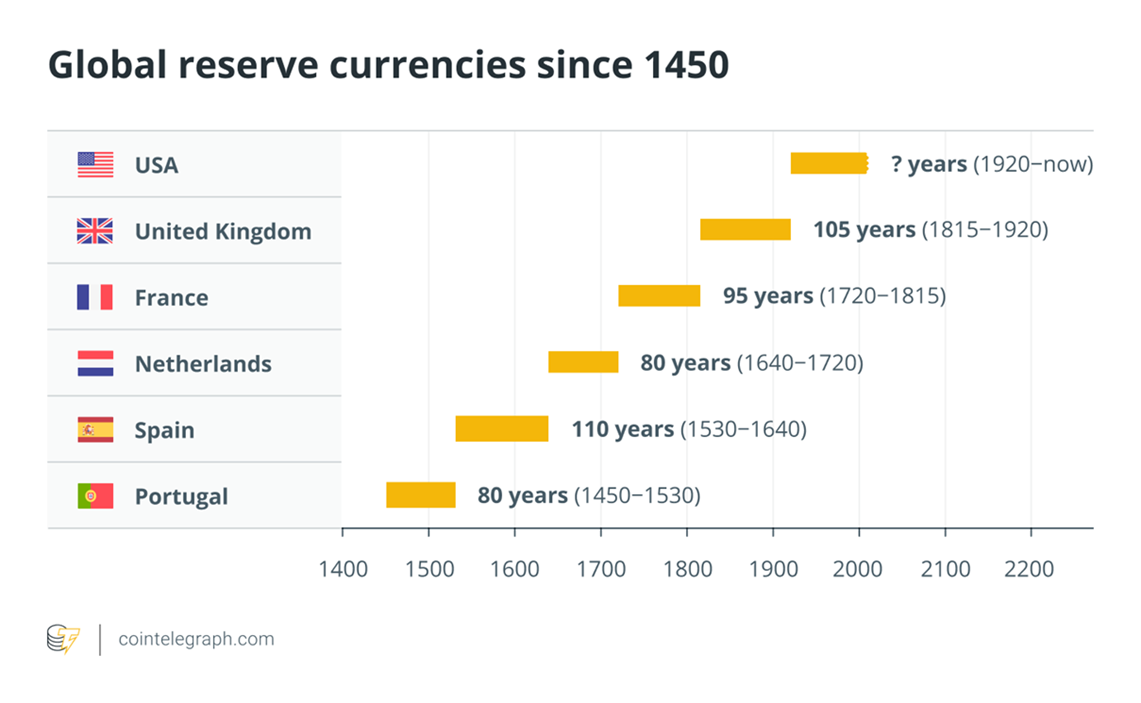

Historically, change is one of the few guaranteed things in modern man’s life. With the precedent of using weaponized finance against your own citizens (Canada) and foreign citizens (US on Russia) set…

The only questions are how and when will weaponized finance be used against you?

Most likely culprit

Like your sociopath ex-boyfriend who consistently lies and cheats on you and tells you “This time is different, I’ve changed!” Your country’s government has lied, manipulated, and done everything humanly possible to brainwash you to trust them whether you realize it or not.

Historically, governments have consistently lied to their own and foreign citizens and used them as pawns in their chess game of power.

The egregious lies of both the most recent and current U.S. administrations need no further exploration.

Central Backed Digital Currencies (CBDCs) will be no different.

The wolf in a sheep’s skin: Central Backed Digital Currencies (CBDCs)

Get used to CBDCs because every government would love to institute one because they can control everything with it.

You do or say something they don’t like? Potential methods of attack:

- freeze your account so you can’t make purchases

- penalize you immediately by taking money out of your account

- make your interest rates negative

- block transactions to certain businesses, types of transactions, and the list goes on

“Oh, this is too crazy. That would never happen.” Some might say.

Well, it just happened in the “7th Freest Country” in the world in February.

CBDCs pose the biggest threat to peoples’ freedom to transact in money’s history and needs to be scrutinized in depth because of how slippery a slope giving control of your money to a government is.

i.e. if you ever disagreed with the past or the current U.S. administration, you could be subject to weaponized finance with CBDCs if you were critical of either and/or both administrations.

How do you protect yourself?

Simple: c̶h̶o̶o̶s̶e̶ ̶t̶o̶ ̶l̶i̶v̶e̶ ̶i̶n̶ ̶t̶h̶e̶ ̶b̶e̶s̶t̶ ̶c̶o̶u̶n̶t̶r̶i̶e̶s̶,̶ ̶e̶n̶s̶u̶r̶e̶ ̶y̶o̶u̶’̶r̶e̶ ̶o̶n̶ ̶b̶o̶a̶r̶d̶ ̶w̶i̶t̶h̶ ̶e̶v̶e̶r̶y̶ ̶h̶o̶t̶ ̶p̶o̶l̶i̶t̶i̶c̶a̶l̶ ̶a̶n̶d̶ ̶m̶e̶d̶i̶a̶ ̶t̶r̶e̶n̶d̶,̶ ̶a̶n̶d̶ ̶n̶e̶v̶e̶r̶ ̶s̶a̶y̶ ̶a̶n̶y̶t̶h̶i̶n̶g̶ ̶c̶r̶i̶t̶i̶c̶a̶l̶ ̶o̶f̶ ̶a̶n̶y̶o̶n̶e̶ ̶i̶n̶ ̶p̶o̶w̶e̶r̶.̶

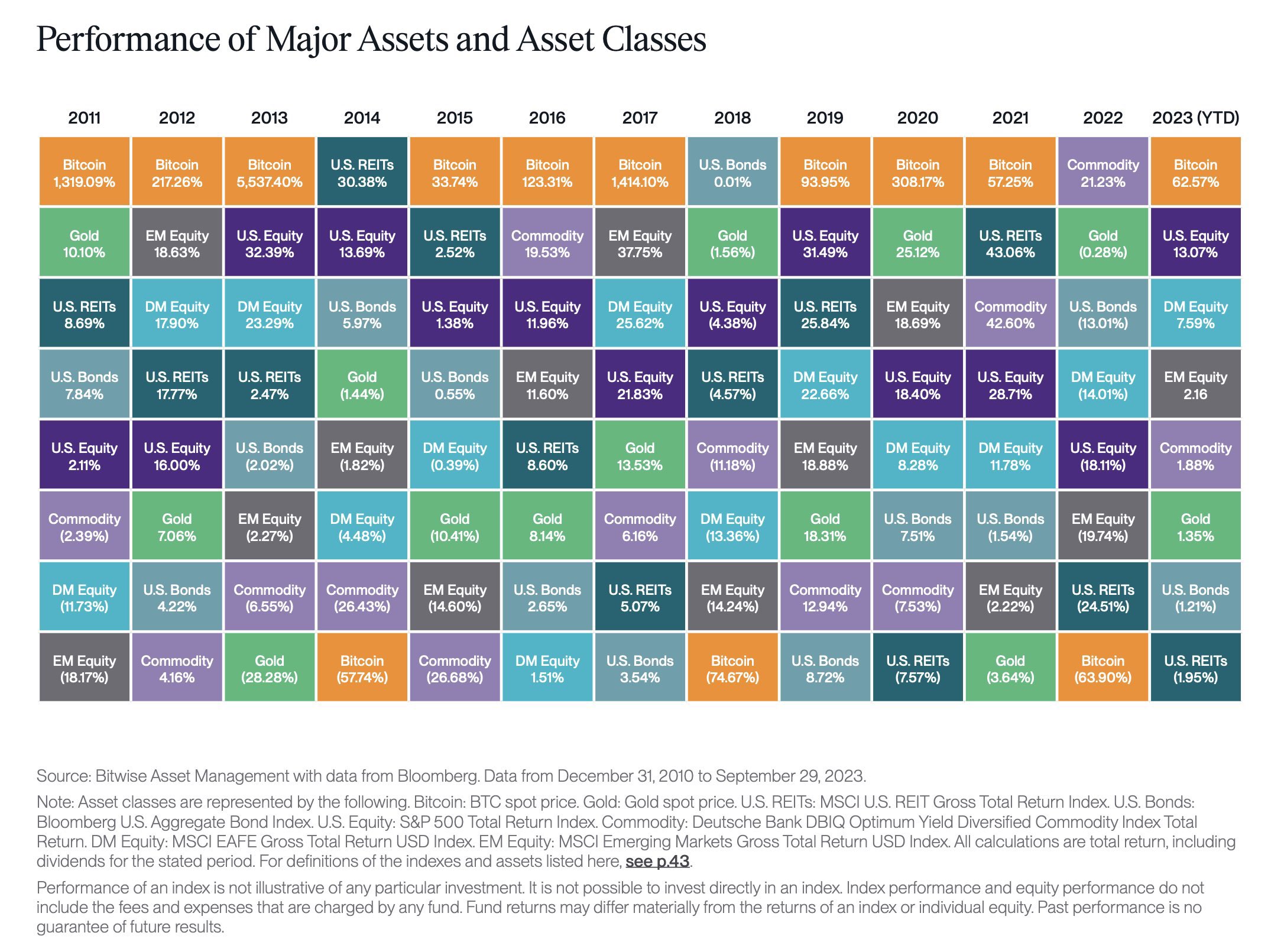

Own assets that the government can’t censor you from using. Decentralized assets like Bitcoin and Ethereum fall into this category. If you don’t like assets with large volatility, a decentralized stablecoin RAI could be an option.

These assets are currently early in adoption, highly volatile, and highly risky. These decentralized options will mature, become safer, and multiply with time.

Traditional “hard assets” like owning real estate or gold are hard to claim. However, during times of crisis and war, these have been claimed i.e., the U.S. in 1933 seizing all citizen’s gold and/or seized by foreign/domestic armies (insert any army’s preferred invasion ).

Understanding crypto is like understanding the internet in the late 90’s and early 2000’s: using it, experimenting with it, and learning about it will give you incredible insight of where the world is going.

Crypto might even save you in times of crisis and uncertainty like it has for Ukrainians fleeing their homes in a war-ridden country.

Welcome to the world’s power dynamic’s structure. Where humans can protect themselves from governments and opt out of their systems for the 1st time in history with Bitcoin and decentralized assets.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

For crypto folks active in the space, here is a take on 5 stablecoins of interest

Ranking Stablecoins in Crypto A-F:

USDC: A- Backed 1 to 1 by Circle, this is the most trusted stablecoin in the space. If you wanted to redeem your USDC for a dollar, this is the best odds of success. Almost all DeFi protocols use USDC in them and almost all crypto exchanges will accept and/or trade USDC pairs. This is the best centralized stablecoin hands down in reDeFi’s opinion.

Tether (USDT): C- Backed by unknown assets, this is historically one of the most polarizing, scrutinized, and most accepted stablecoin in crypto. The movies that’ll be made on Tether (USDT) will be incredible. How it was created, how it potentially was printed out of thin air to prop up the price of Bitcoin in previous bear markets, and who has been involved in this is arguably the most fascinating thriller in the crypto space. Must read on it.

The likelihood that it is not backed 1 to 1 and is backed partially by sub-par assets is high. However, the liquidity/common use of the world’s largest stablecoin makes it almost “too big to fail.” Every large crypto exchange and company would do everything in their power to make sure the 4th largest crypto by market cap stays afloat and in good financial standing. Hence why it isn’t any lower because the incentives for crypto companies to backstop Tether in case anything happens to it is enormous.

Terra (UST): D- “D” for Do Kwon who founded this flawed mechanism. It is not an “F” because the Terra Foundation who created UST essentially acknowledged it was a flawed mechanism, knew they were doomed, and attempted to get the stablecoin backed by market buying billion $’s of Bitcoin.

UST #10 market cap is flawed because of its design. Each UST is backed by LUNA the #8 market cap token and redeemable for LUNA. So, if you want to get out of UST, you will in return get LUNA. But what happens if a lot of people want to get out of UST and redeem it for LUNA (which backs it)?

What happens if the price of LUNA drops, and the market cap of UST is higher than LUNA? Well, this UST would be then worth less than $1 and likely trigger a bank run as users rush to get out of an asset that is no longer $1. They would keep getting LUNA in return and traders would want to get out of LUNA as soon as possible because a death spiral would commence. Essentially leading to the destruction of a top 15 market cap stablecoin and crypto project.

DAI: C Dai doesn’t succeed at its founding premise of being a decentralized stablecoin. Nearly ½ of DAI is backed by USDC. So, if a government swoops in and bans stablecoins and freezes USDC, DAI is screwed too because ~ ½ their holdings are in USDC. So it doesn’t really do anything that great besides being around for a while and having good liquidity.

RAI: B+ This is the most important stablecoin in my opinion. USDC and USDT allow for anyone in crypto to move into stables (aka out of your bitcoin or Ethereum position into a crypto asset pegged to a dollar). RAI is a decentralized stablecoin backed by Ethereum that is censorship proof meaning no government can shut it down like a centralized stablecoin.

The whole purpose of Bitcoin and crypto is primarily to be able to operate without government permission because governments and central banker’s history is littered with lies. Another great aspect of RAI is that it isn’t pegged at $1. Pegs historically break. RAI is a range based asset where the price is normally around $3.01 and floats up or down a few cents. Market makers are incentivized to buy RAI when the price goes down a few cents and sell RAI once it goes up above $3.01 to get ETH at a discount.

The only knock on it is it’s market cap which is around $50m as of time of writing. It has been around for over 1 year and has lived up successfully to its mission: More liquidity/use of it, track records of navigating volatility successfully, and better marketing/use in the crypto space will make this the best stablecoin in crypto.

Disclosure: I’m not a financial advisor. This is not financial advice. These are highly speculative assets early in adoption and investors can lose all of their investment. The author may have positions in the assets discussed.