2022 was a year of “bold” predictions and unfortunately we were 3/3 on bad ones (nailed 3/5 predictions).

· Celsius being a Ponzi scheme

· Terra (LUNA) + its stablecoin UST blowing up

· Metaverse Tokens SAND + MANA going from ~$3.5B marketcaps to sub <$1B marketcaps

But hey, we were happily right about another country adopting Bitcoin as legal tender (Central African Republic)!

We project 2023 will be a quieter year and that only a few semi-big names will go under.

Let’s start with the good stuff.

2023 Good Predictions:

Major(s) Crypto Strength

Bitcoin and Ethereum (the majors) will be the king and queen of ’23. Both ended ’22 ~ -75% down from all time highs.

Bear markets have historically seen Bitcoin drop -80% +. So historically, the bottom is likelier close to being in or has been hit already.

Small cap cryptos (alts) have endurance issues and most pumps in the alt markets are unsustainable without strength in the majors (Bitcoin and Ethereum).

Alt tokens (small cap cryptos) in crypto are a casino that are primarily narrative driven and the narratives will pile in once Bitcoin and Ethereum “have pumped too much” and retail (gamblers)/unsophisticated investors/”TradFi” look for the “next Ethereum” in the most volatile markets in the world — crypto.

Until crypto token holders receive revenue fees from their protocol, they are essentially a narrative play because ~no tokens give revenue to their holders, they just give you the right to “vote” in most cases (barring the token being used as the currency in the game, for transaction fees, or a future belief that token holders will get a revenue share and/or some other value prop).

“Thee” Game Hits

Candycrush, Pokémon Go, Wordle, etc. have all hit on mobile apps.

Blockchain’s moment in the sun is going to hit in ’23 where 1/3 of top games of ’23 played on mobile are “blockchain”, “crypto”, “NFT” related, or all the above.

The amount of money being poured into blockchain projects (especially the gaming space) is ungodly. Similar to our “it’s a matter of ‘when’ Terra/UST collapses in ’22 (not an ‘if’)”, we would bet the house on a blockchain game hitting the mainstream in the coming years.

We’re bullish on it hitting in Jordan’s year (‘23).

2023 Bad Predictions:

https://cdn.embedly.com/widgets/media.html?src=https%3A%2F%2Ftenor.com%2Fembed%2F16177531&display_name=Tenor&url=https%3A%2F%2Ftenor.com%2Fview%2Fjail-right-to-jail-right-away-parks-and-recreation-parks-and-rec-gif-16177531&image=https%3A%2F%2Fmedia.tenor.com%2FsFGB4cW82U8AAAAC%2Fjail-right-to-jail.gif&key=a19fcc184b9711e1b4764040d3dc5c07&type=text%2Fhtml&schema=tenor

Questionable Businesses Go Under

Crypto.com, Gate.io, Nexo, and some other questionable centralized exchanges (Coinbase = a centralized exchange) go under and are looking like they’re jail bound.

The fiasco of Crypto.com sending ~$416M in Ethereum to the wrong crypto address on “accident” for ~2 weeks right before Gate.io does a “proof of reserves” audit for the 1st time in 2 years is beyond eye raising.

But don’t worry, Gate.io sent back the Ethereum after two weeks. They also didn’t send back the full amount sent to them — Crypto.com appears like they got conned by better conmen at gate.io.

Both seem insolvent or something bad is going on with them —I wouldn’t touch these platforms with serious capital.

Nexo’s offices already got raided so a little late on this one (called it in ’22 they’d go under, but oh well)

“Goldman Gary” Continues To Try and Kill Crypto

The U.S.’s favorite banker, Gary Gensler will continue to try and kill crypto.

“Goldman Gary” is doing everything possible to kill the crypto space and crypto native businesses in order for his former employer(s) (i.e. Goldman Sachs) to play catchup and take advantage of Gensler deeming everything a “Security” so that only his banking buddies can offer crypto related products and no one else.

Every crypto business and leader excluding soon to be convicted of fraud Sam Bankman-Fried (SBF) CEO of FTX has been met with extreme hostility by Gary Gensler.

Regulation by enforcement + providing zero regulatory clarity has been the approach to crypto companies which encourage U.S. companies/projects to go offshore and kills the industry onshore in the U.S. (terrible for U.S. competetiveness).

Gensler’s Garbage Bin? Full of Sin

Gensler was very friendly with Bankman-Fried + FTX and met with them multiple times, yet the “watchdog” did nothing

He has 2x better odds of making the cover of Time Magazine than being tried for his shady dealings or resigning in my opinion.

More regulation by enforcement is on queue for 2023.

The Underdog:

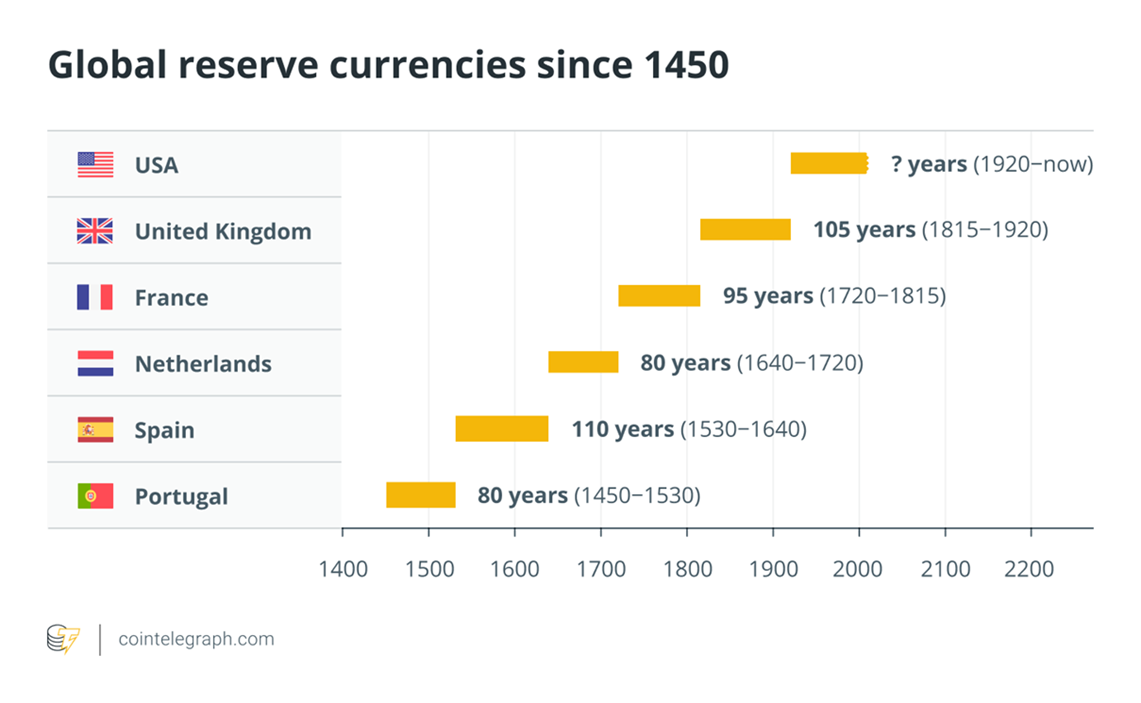

Bitcoin and crypto’s original ideals of being a financial system alternative to central banking is what drives the next bull market.

Bitcoin’s Genesis Block was mined with this message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks…”

Bitcoin was created as an alternative financial system to traditional finance and modern-day money printing operations that we call central bankers.

Rampant inflation, financial censorship of individuals, and distrust of central bankers are what will unfortunately drive crypto adoption.

However, I believe crypto is in a “make or break” period in the next 2–3 years. The conditions for its adoption are ripe. However, the world’s current power brokers are highly incentivized against crypto becoming mainstream.

Once defeat is guaranteed, regulators/banks will change the rules so the banks can control/run the crypto space and finally unleash their own huge marketing campaign for crypto (related to thesis on why Gensler is “killing” crypto).

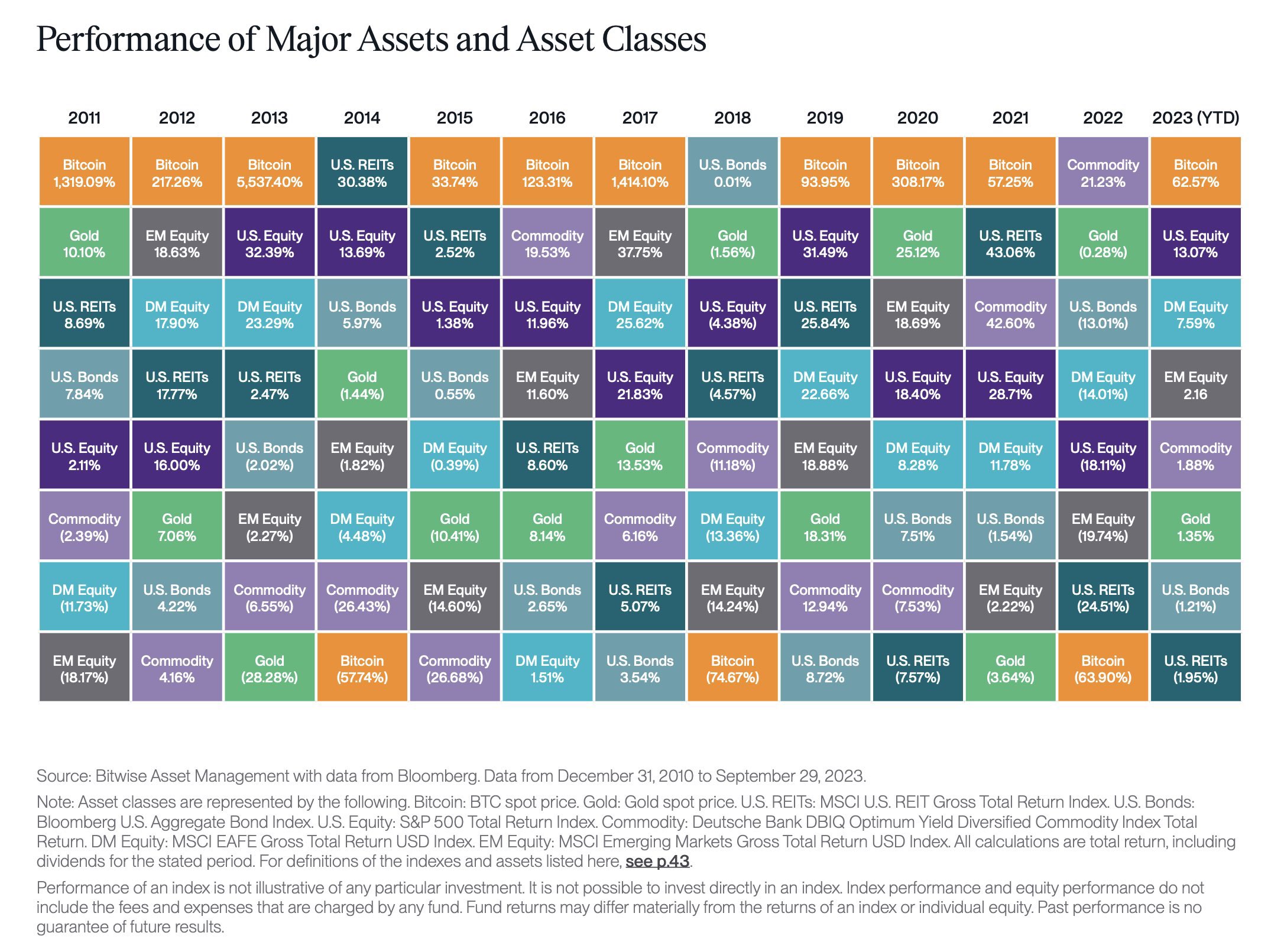

Make no mistake: crypto is the ultimate “risk on” asset. When traditional markets go up, crypto goes up further and vice versa.

We believe that once the markets find a bottom, Bitcoin and crypto will lead the rally by a substantial margin with its founding principles as the driving narrative.

Disclosure: This is not financial advice. Bitcoin and cryptocurrencies are extremely “risky” investments. The author(s) may own cryptocurrencies.

Format + disclosure update 2/28/2023